PM Youth Business Loan 2026 Interest-Free

PM Youth Business Loan 2026 Interest-Free Prime Minister’s Youth Business & Agriculture Loan Scheme (PMYB&ALS) 2026 has once again become a major topic of discussion across Pakistan. At a time when rising inflation, limited job opportunities, and financial pressure are affecting families in both urban and rural areas, the government has introduced a practical solution for young people who want to stand on their own feet. The PM Youth Business Loan 2026 interest-free category is specially designed for students, freelancers, and small entrepreneurs who have ideas but lack capital.

In recent years, we have seen many young Pakistanis struggling to secure bank loans due to high markup rates and strict collateral conditions. Traditional financing is not easy for a student or a beginner. This is why the interest-free feature of this scheme is being considered a lifeline. It removes the fear of interest and gives youth the confidence to start small businesses, online ventures, and agriculture projects without financial burden.

The focus of this guide is to explain everything in simple language so that even an ordinary citizen can understand how the PM Youth Loan 2026 works, who can apply, what documents are required, and how repayment is structured.

You Can Also Read: DG Khidmat Ramadan Nigahban Program 2026

What Makes PM Youth Business Loan 2026 Important for Students?

The biggest challenge for Pakistani students after completing education is employment. Government jobs are limited, and private sector opportunities are highly competitive. Many talented students have skills in IT, freelancing, graphic design, agriculture, and small trade, but they lack startup funds. This scheme directly addresses that issue.

The interest-free category under Tier 1 allows youth to borrow up to PKR 500,000 without paying any markup. This is not just a loan; it is a policy shift toward promoting self-employment and entrepreneurship. Instead of waiting for a job, young individuals can now create their own source of income.

This initiative is also aligned with Pakistan’s digital transformation goals. The government is encouraging online businesses, freelancing, e-commerce stores, and agriculture modernization. For students who already earn through platforms like Fiverr, Upwork, Amazon, or Shopify, this loan can help them expand their operations.

You Can Also Read: 1500 Prize Bond List 2026 February 2026

Key reasons why this scheme matters:

- Encourages self-employment instead of job dependency

- Provides clean loans without interest

- Supports IT, freelancing, and e-commerce startups

- Helps small shop owners expand operations

- Promotes financial inclusion for low-income families

- Strengthens Pakistan’s small and medium enterprise sector

For many families, this scheme is not just financial support but an opportunity to improve their standard of living.

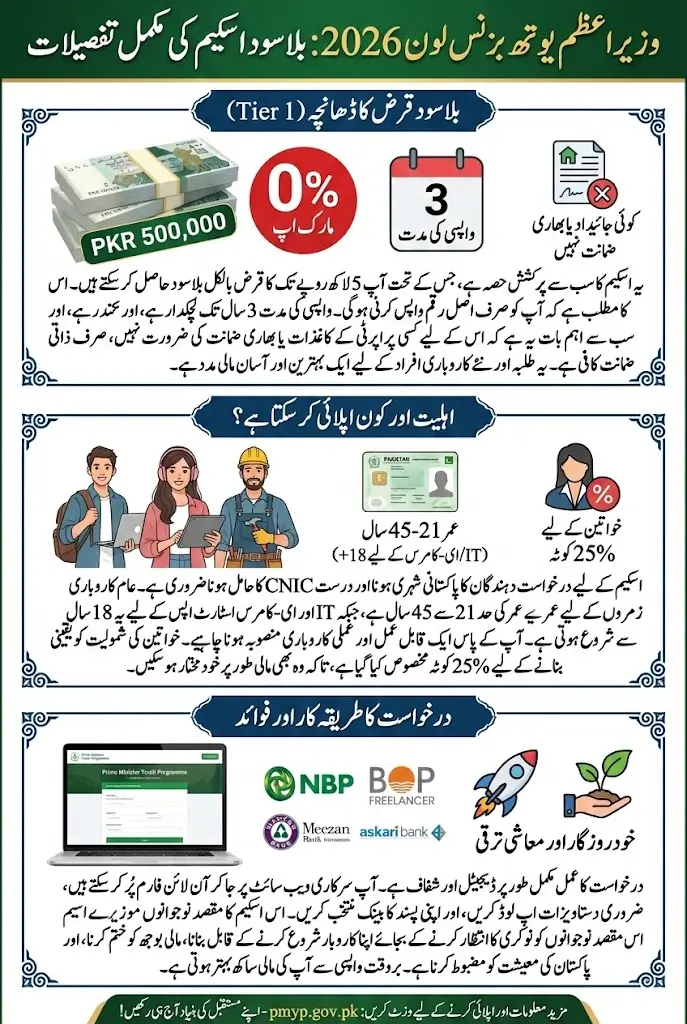

Complete Details of Interest-Free Loan Structure

The most attractive feature of PM Youth Business Loan 2026 is its Tier 1 interest-free category. Under this structure, applicants can receive up to PKR 500,000 with zero percent markup. This means the borrower returns only the original amount without any additional interest.

Unlike commercial bank loans, there is no requirement for property documents or heavy collateral. The loan is considered a clean loan, and only a personal guarantee is required. This makes it accessible for students and beginners who do not own assets.

The repayment period is flexible and can extend up to three years. This allows enough time for the business to stabilize and generate income before full repayment.

You Can Also Read: 8123 Ehsaas Rashan Program 2026

Below is a clear summary of Tier 1 loan details:

| Feature | Details |

|---|---|

| Maximum Loan Amount | Up to PKR 500,000 |

| Markup Rate | 0% (Completely Interest-Free) |

| Repayment Duration | Up to 3 Years |

| Collateral Requirement | Not Required |

| Security | Personal Guarantee |

| Target Applicants | Students, Youth & Small Entrepreneurs |

This structure clearly shows that the government wants to remove financial barriers for young entrepreneurs.

Eligibility Criteria for PM Youth Loan 2026

The eligibility criteria have been designed to cover a wide range of applicants. The goal is to include students, freelancers, skilled workers, and small business owners from across Pakistan.

For most business categories, the age requirement is between 21 and 45 years. However, for IT and e-commerce startups, the minimum age is 18 years. This relaxation is especially beneficial for young digital entrepreneurs who start earning early.

Applicants must meet the following conditions:

- Must be a Pakistani citizen

- Valid Computerized National Identity Card (CNIC) required

- Age between 21–45 years (18+ for IT and e-commerce)

- Must present a workable and practical business idea

- Existing small businesses can also apply

- 25% quota reserved for women entrepreneurs

The inclusion of women through a reserved quota ensures that female entrepreneurs, including home-based workers, have equal access to financial support.

You Can Also Read: 8171 Check Online 2026 CNIC Verification Payment

Business Sectors Covered Under the Scheme

One of the strengths of PMYB&ALS 2026 is that it is not limited to a specific sector. Whether someone wants to open a small retail shop in a village or start an online store in a city, the scheme covers both traditional and modern businesses.

From previous phases, we have seen successful examples in retail, agriculture, IT services, and home-based enterprises. The government has especially increased support for digital and freelancing sectors in 2026.

Eligible business types include:

- Grocery stores and small retail shops

- E-commerce and dropshipping businesses

- Amazon, Daraz, and Shopify stores

- Freelancing services such as graphic design and programming

- Agriculture farming and livestock projects

- Food stalls, catering, and bakery setups

- Mobile repair and electronics workshops

- Beauty salons and tailoring businesses

This wide coverage allows applicants to choose a business based on their skills, education, and local demand.

You Can Also Read: Ramzan Nighban Program 2026 Online Registration

Step-by-Step Online Application Process

The government has introduced a digital application system to ensure transparency and reduce unnecessary delays. Applicants can apply online without visiting multiple offices.

The process begins by visiting the official Prime Minister Youth Programme website. After creating an account, applicants must carefully fill in personal and business details.

Application steps include:

- Register using CNIC, mobile number, and email

- Fill in personal information accurately

- Submit business proposal and estimated expenses

- Mention expected monthly income and profit

- Upload required documents

- Select a participating bank

- Receive tracking number for status updates

Participating banks include:

- National Bank of Pakistan (NBP)

- Bank of Punjab (BOP)

- Meezan Bank

- Askari Bank

After submission, the bank reviews the application under government guidelines. Applicants can track their status online using the provided tracking number.

You Can Also Read: PSER Registration Form 2026 For Ramzan Relief Package

Repayment Policy and Financial Discipline

The repayment structure is designed to remain manageable for young entrepreneurs. Borrowers are allowed up to three years to repay the interest-free loan.

Monthly installment plans are offered to ensure affordability. In some cases, a grace period may be provided depending on the nature of the business. Early repayment is allowed without penalty, which benefits those whose businesses grow quickly.

Important repayment points to remember:

- Maximum repayment period is 3 years

- Monthly installments are structured for ease

- Grace period may be available

- No extra charges for early repayment

- Late payments may affect future eligibility

Maintaining regular payments not only avoids legal issues but also builds financial credibility for future business expansion.

Documents Required for Application

Preparing documents in advance increases approval chances and reduces processing delays. Incomplete or incorrect information can slow down verification.

Applicants usually need:

- Copy of valid CNIC

- Recent passport-size photograph

- Business plan or proposal

- Educational or technical certificates if available

- Proof of residence

Providing accurate and honest information is essential because banks verify details before approval.

You Can Also Read: Punjab Nigehban Rashan Program Registration

Economic Impact and Long-Term Benefits

The PM Youth Business Loan 2026 interest-free scheme is not only about individual support; it also contributes to national economic growth. When a student starts a small business, it creates income for their family and may generate jobs for others.

By supporting small and medium enterprises, the government is strengthening the foundation of Pakistan’s economy. Digital entrepreneurship, agriculture development, and retail expansion all contribute to GDP growth and reduced unemployment.

The long-term benefits include:

- Reduction in youth unemployment

- Growth of SME sector

- Increased digital exports through freelancing

- Women financial empowerment

- Improved rural economic activity

If implemented properly and utilized responsibly, this scheme can transform thousands of young lives.

You Can Also Read: Nigehban Ramzan Package 10000 Payment Update

Final Thoughts

The PM Youth Business Loan 2026 Interest-Free scheme is one of the most impactful financial initiatives currently available for Pakistani students and young entrepreneurs. By offering loans without markup and without collateral, the government has removed the biggest barriers that prevent youth from starting businesses.

For students with skills and ambition, this program can become a turning point. With careful planning, a realistic business idea, and disciplined repayment, the scheme offers a genuine opportunity to achieve financial independence and long-term stability.