Parwaz Card Registration Portal

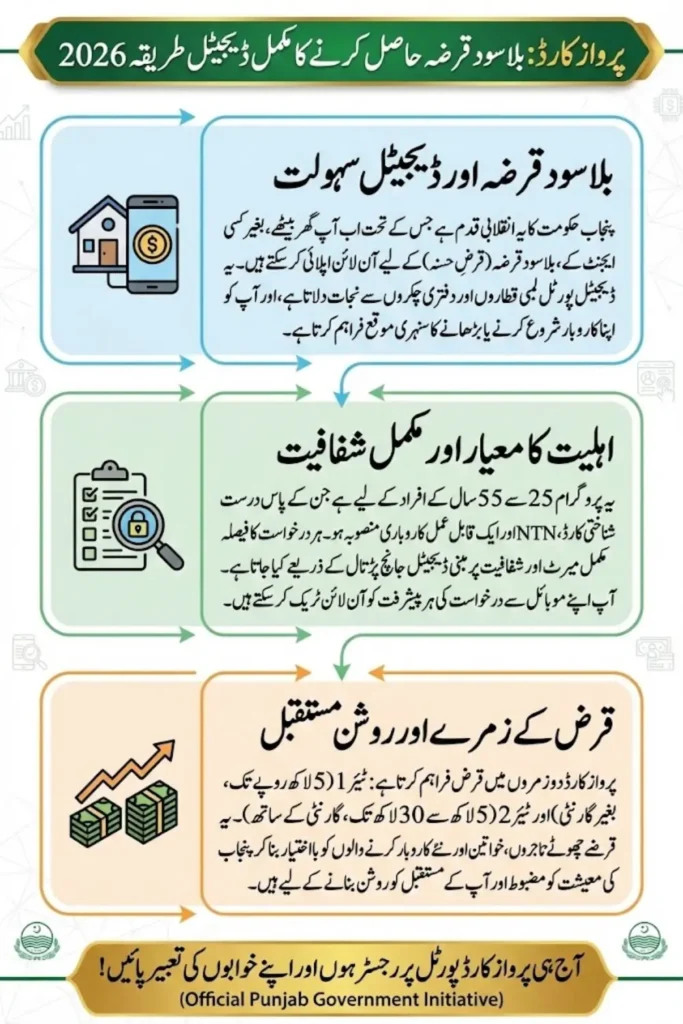

Parwaz Card Registration Portal Punjab Government has officially activated the Parwaz Card Registration Portal to provide a modern, transparent, and fully digital way for citizens to apply for interest-free business loans. This step reflects a major shift from traditional manual systems toward online governance, where applicants no longer need to visit offices, stand in long queues, or rely on agents. Everything, from registration to tracking, is now accessible through a single online platform.

From what I have personally observed, this digital system is especially helpful for people living outside major cities. Small traders, shopkeepers, freelancers, and home-based workers can now apply from their homes using just a CNIC and a mobile phone. The portal not only saves time but also ensures that every applicant is treated fairly, without personal influence or favoritism.

You Can Also Read: CM Punjab Green Tractor Scheme Phase-III

The digital launch aims to:

- Eliminate paperwork and unnecessary delays

- Provide equal access to business financing

- Reduce dependency on middlemen

- Strengthen trust in government systems

Vision Behind Interest-Free Business Financing

The Parwaz Card Program is built on the principle of interest-free loans (Qarz-e-Hasna), which is a major relief for people who avoid conventional bank loans due to high interest rates. The Punjab Government recognizes that many capable individuals fail to start businesses simply because they cannot afford interest-based borrowing. This initiative directly addresses that issue.

In practical terms, this program encourages people to invest in their skills and ideas without fear of falling into debt. Whether someone wants to open a small shop, start an online business, or expand an existing setup, the Parwaz Card provides financial support without additional financial pressure. This approach promotes long-term stability rather than short-term survival.

The core objectives include:

- Encouraging entrepreneurship across Punjab

- Supporting self-employment opportunities

- Reducing unemployment through small businesses

- Strengthening the local economy

You Can Also Read: eBiz Punjab Portal 2026: How to Apply for Business

Who Can Benefit From This Financial Initiative

The Parwaz Card Program has been designed with inclusivity in mind. It is not limited to large businesses or well-connected individuals. Instead, it focuses on ordinary citizens who have genuine business ideas or ongoing small businesses and need financial support to grow.

Based on ground realities, this initiative is particularly beneficial for youth and women who often struggle to access formal financing. Home-based businesses, startups, and small enterprises finally have a structured platform where their applications are evaluated purely on eligibility and feasibility.

This program mainly benefits:

- Young individuals planning startups

- Women running home-based businesses

- Small shop owners and traders

- Small and medium enterprises (SMEs)

- Environment-friendly business projects

You Can Also Read: Oppo Reno15 Pro 5G With Dimensity 8450

How the Online Portal Improves Transparency

Transparency is one of the strongest aspects of the Parwaz Card Registration Portal. Every action taken on an application is digitally recorded and visible to the applicant. There is no hidden process or unclear decision-making, which was a common complaint in older systems.

Applicants can log in anytime to see where their application stands. This transparency builds confidence and reduces unnecessary stress. It also ensures that approvals and rejections are based on data verified through official government databases.

Key transparency features include:

- Secure CNIC-based login

- Real-time application tracking

- Automated verification systems

- Clear status updates at every stage

Understanding Loan Structure Without Complexity

The Parwaz Card loan structure is intentionally kept simple so applicants do not feel overwhelmed. Loan categories are divided based on business size and financial needs, allowing applicants to choose wisely rather than taking unnecessary financial risks.

This structured approach ensures responsible lending. Small startups are not burdened with large loans, while established businesses can access higher amounts for expansion. From my experience, selecting the correct loan tier significantly improves approval chances.

You Can Also Read: بے نظیر انکم سپورٹ پروگرام میں اہلیت اور رقم کی جانچ کرنے کا مکمل طریقہ

Parwaz Card Loan Categories Overview

| Loan Category | Loan Amount Range | Collateral Requirement | Best For |

|---|---|---|---|

| Tier 1 | Up to PKR 500,000 | Not Required | Startups, small traders |

| Tier 2 | PKR 500,000 – 3,000,000 | Required | SMEs and expanding businesses |

Online Registration Flow Explained Simply

The registration process on the Parwaz Card Portal is user-friendly and designed for first-time applicants. Even individuals with limited digital experience can complete the application by following on-screen instructions.

Applicants are allowed to review their details before final submission, which reduces errors and rejection chances. This careful design shows that the system is made for public convenience, not just formality.

The registration process involves:

- Visiting the official Punjab government portal

- Registering with CNIC and mobile number

- Verifying identity through OTP

- Selecting the appropriate loan category

- Completing the application form and uploading documents

You Can Also Read: 8171 Validation To Check BISP 13500

Tracking Your Application From Home

One of the most appreciated features of the Parwaz Card Portal is the CNIC-based tracking system. Applicants do not need to visit offices or wait for phone calls. Everything is available online through the personal dashboard.

The tracking system provides clarity and keeps applicants informed. If additional information is required, it is clearly mentioned, allowing applicants to respond quickly.

Applicants can track their status by:

- Logging into the portal

- Entering CNIC credentials

- Accessing the application dashboard

- Viewing real-time status updates

You Can Also Read: BISP Waseela e Taleem Online Registration

How Applications Are Screened Digitally

Once an application is submitted, it goes through a structured digital verification process. CNIC details are verified through NADRA, while financial and tax information is checked through relevant government systems. This ensures accuracy and fairness.

Applicants receive updates through SMS and portal notifications. This digital screening minimizes delays and reduces chances of human error.

Verification steps include:

- Identity verification

- Financial and tax assessment

- Business feasibility review

- Final approval or rejection

Preparing Documents Before Applying

Document preparation plays a critical role in fast approval. Incomplete or unclear documents are one of the main reasons applications are delayed or rejected. Applicants should ensure all documents are clear, valid, and up to date.

From observation, applicants who prepare documents in advance experience a much smoother process. This simple step can save significant time.

Important documents include:

- Valid CNIC

- NTN certificate

- Clear business plan

- Recent utility bill

- Collateral documents (if applicable)

You Can Also Read: Pser Survey Registration 2026

Smart Practices to Avoid Fraud and Delays

The Parwaz Card Program is completely free, and no agent is authorized to collect fees. Unfortunately, fake calls and pages often appear during such initiatives. Citizens must remain cautious and rely only on official sources.

Following official instructions carefully not only protects applicants from fraud but also ensures timely processing of applications.

Applicants should remember to:

- Never pay any agent or middleman

- Apply only through the official portal

- Provide accurate CNIC and contact details

- Regularly check portal updates

You Can Also Read: Federal Board Class 11 & 12 Second

Impact of Parwaz Card on Small Businesses in Punjab

The Parwaz Card Program has the potential to reshape small business culture in Punjab. Interest-free financing encourages people to invest confidently, expand operations, and create employment opportunities.

For many small traders and home-based workers, this initiative can be a turning point. It promotes dignity, self-reliance, and sustainable growth at the grassroots level.

Final Thoughts

The activation of the Parwaz Card Registration Portal is a strong step toward digital financial inclusion in Punjab. By combining interest-free loans with a transparent online system, the government has made business financing accessible to ordinary citizens.

Eligible individuals should apply responsibly, ensure accurate information, and use this opportunity wisely. If implemented properly, this initiative can bring long-term economic improvement across Punjab.

You Can Also Read: PTA Spectrum Auction Update Technology

FAQs

What is the Parwaz Card Portal used for?

It allows citizens to apply for and track interest-free business loans online.

Can applications be tracked using CNIC?

Yes, CNIC-based login enables real-time tracking.

Is there any registration fee?

No, the application process is completely free.

Who is eligible to apply?

Punjab residents aged 25 to 55 with a valid CNIC, NTN, and business plan.

How long does verification take?

Processing time varies, but digital verification ensures faster decisions.