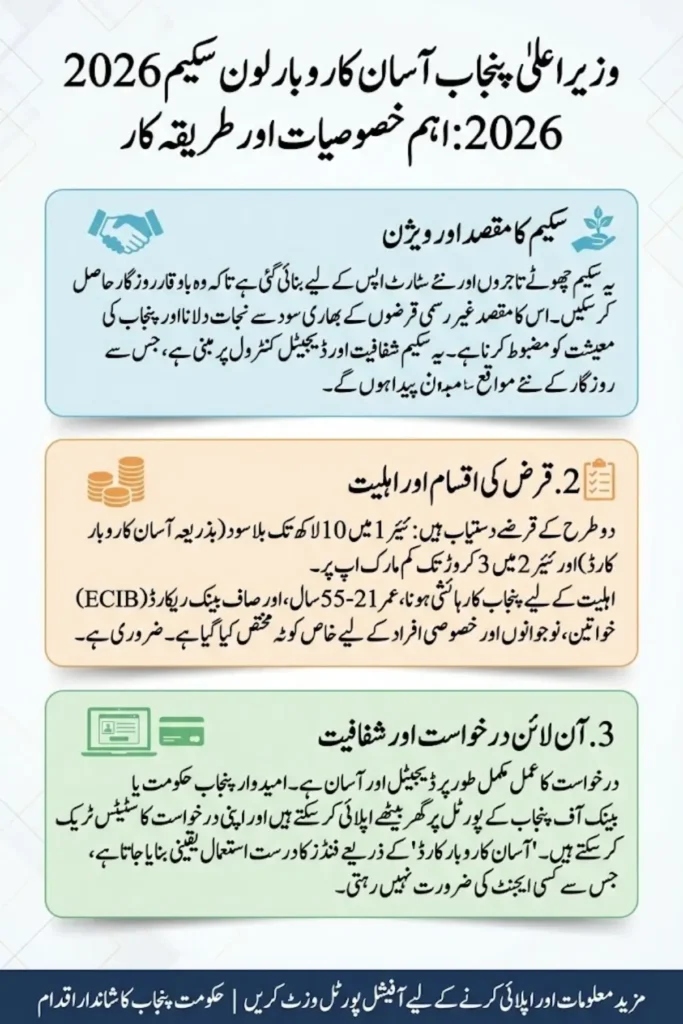

CM Punjab Asaan Karobar Loan Scheme 2026

The CM Punjab Asaan Karobar Loan Scheme 2026 is one of the most practical financial support programs introduced for small traders, startups, and growing businesses in Punjab. From what I have personally observed while covering government initiatives, the biggest issue for ordinary Pakistanis is not lack of ideas but lack of access to fair financing. Banks often demand heavy collateral, guarantors, and complex paperwork that most small entrepreneurs cannot provide.

This scheme directly addresses that problem by offering interest-free and low-markup loans, a digital application system, and clear eligibility rules. For 2026, the Punjab Government has further streamlined the process so applicants can apply, track status, and receive updates without relying on agents or visiting offices again and again.

You Can Also Read: CM Punjab Parwaz Card 2026 Application

Introduction to CM Punjab Asaan Karobar Loan Scheme 2026

Asaan Karobar is designed for people who want to stand on their own feet through business rather than depend on unstable jobs or informal borrowing. The scheme supports both new startups and existing businesses that want to expand operations, purchase equipment, or manage working capital.

What makes this program different from past loan schemes is its focus on transparency and digital control. The government has tried to remove confusion by clearly defining loan limits, repayment periods, and eligibility so that even a first-time applicant can understand the process.

You Can Also Read: PM Laptop Scheme 2026 – Know Full Process of Registration

Purpose and Vision of the Asaan Karobar Finance Initiative

The core vision behind this initiative is to strengthen Punjab’s economy through small and medium enterprises, which are the backbone of employment in Pakistan. When small businesses grow, jobs are created locally, and dependency on large corporations or government employment decreases.

Another important objective is to reduce exploitation by informal lenders who charge excessive interest. By offering government-backed financing, the scheme gives people a safer and more reliable option to invest in their livelihoods.

Who Should Consider Applying in 2026

This loan scheme is suitable for a wide range of people across Punjab, particularly those who have skills but limited capital. From small shopkeepers to service providers, many categories of workers can benefit.

People who should seriously consider applying include:

- Individuals planning to start a small business

- Existing shop owners wanting to expand

- Home-based business operators

- Skilled workers starting workshops or service units

- Small manufacturers and traders

You Can Also Read: Shabe Meraj 2026 In Pakistan

Loan Categories and Financing Structure for 2026

The Asaan Karobar Scheme offers two financing tiers, carefully structured to match the needs of small startups and larger SMEs. This separation helps ensure that small applicants are not pushed into unnecessary collateral requirements.

| Loan Feature | Tier 1 – Interest Free | Tier 2 – SME Financing |

|---|---|---|

| Maximum Loan Amount | Up to PKR 1 Million | PKR 5 Million to 30 Million |

| Interest / Markup | 0% Interest | Approx. 6%–8% |

| Repayment Period | Up to 3 Years | Up to 5 Years |

| Grace Period | 3 Months | 3–6 Months |

| Security Requirement | Personal Guarantee | Collateral / Property |

This structure allows applicants to choose a loan category based on their actual business scale instead of being forced into unsuitable options.

Understanding the Asaan Karobar Card (Digital SME Card)

For Tier 1 loans, financing is provided through the Asaan Karobar Card, which works as a controlled digital credit facility. Instead of handing over cash, the government ensures that funds are used strictly for business purposes.

From a transparency point of view, this system is very effective. Transactions are digitally recorded, reducing misuse and helping businesses maintain proper financial discipline.

Main features of the card include:

- Revolving credit limit

- Direct payments to suppliers

- Cashless transaction system

- Improved record-keeping for small businesses

You Can Also Read: Ehsaas Program 4th Phase Updates

Eligibility Requirements for Asaan Karobar Loan 2026

Eligibility conditions are kept simple so ordinary citizens are not discouraged. However, accuracy is very important, as incorrect information often leads to rejection.

Applicants must:

- Be a resident of Punjab

- Possess a valid CNIC

- Be between 21 and 55 years of age (some cases up to 60)

- Have no bank default history (clean ECIB)

- Present a viable business idea or operating business

Priority Groups and Special Quotas

The Punjab Government has included special quotas to promote inclusivity and economic balance. These quotas help groups that traditionally face financial barriers.

Priority consideration is given to:

- Women entrepreneurs

- Youth applicants

- Persons with disabilities

This ensures that financial support reaches all segments of society.

Required Documents for Online Application

Preparing documents in advance significantly improves approval chances. Many applications fail simply because of missing or unclear paperwork.

Documents required include:

- CNIC copy (front and back)

- Recent passport-size photograph

- Business plan or feasibility report

- Proof of address or business location

- Rent agreement or utility bill if applicable

Step-by-Step Online Application Process

The entire application process is digital and user-friendly. Even applicants with basic internet knowledge can complete the form independently.

Steps involved:

- Visit the official Punjab Government or Bank of Punjab portal

- Register using CNIC and a mobile number in your name

- Fill in personal and business details carefully

- Upload required documents

- Submit the form and save the tracking ID

You Can Also Read: CM Solarization Program Registration Last Date Is Extended

Application Fee and Payment Information

To keep the scheme affordable, the processing fee is minimal. For Tier 1 loans, it is approximately PKR 500.

This fee is paid online and is non-refundable, even if the application is rejected.

How to Check Asaan Karobar Loan Status Online

After submission, applicants can track their application status online using the tracking ID. This feature removes uncertainty and unnecessary office visits.

Common status updates include:

- Application received

- Under verification

- Approved or rejected

- Disbursement in progress

Verification and Approval Stages

Every application goes through multiple verification stages to ensure fairness and transparency. These checks protect public funds and genuine applicants.

Verification includes:

- CNIC validation

- ECIB credit check

- Business plan evaluation

- Field verification where necessary

You Can Also Read: 8171 Check Online CNIC Login Verify Your BISP Eligibility Instantly

Loan Approval and Disbursement Method

Approved applicants are informed through official SMS or portal notifications. For Tier 1 loans, the Asaan Karobar Card is issued via partner banks such as the Bank of Punjab.

Funds are released strictly according to scheme rules to ensure proper utilization.

Important Dates for Asaan Karobar Loan Scheme 2026

Applications are expected to follow this timeline:

- Opening date: January 2026

- Expected closing date: February 15, 2026

Applicants should apply early, as deadlines may be extended or closed without prior notice.

Common Reasons for Loan Rejection

Understanding common mistakes helps applicants avoid rejection.

Major reasons include:

- Incomplete application forms

- Weak business plans

- Incorrect documents

- Existing bank defaults

Why Applying Without Agents Is Safer

The online system allows applicants to apply directly, reducing fraud risks.

Benefits include:

- No agent fees

- Direct communication

- Transparent tracking

- Lower risk of scams

You Can Also Read: Maryam Nawaz Announces Free E-bikes

Final Thoughts for Applicants

The CM Punjab Asaan Karobar Loan Scheme 2026 is a genuine opportunity for Pakistanis who want to build something of their own. With clear rules, digital transparency, and government backing, it provides a realistic path toward financial stability.

Applicants who prepare carefully, apply honestly, and follow official instructions stand a strong chance of benefiting from this scheme.