Acag.punjab.gov.pk

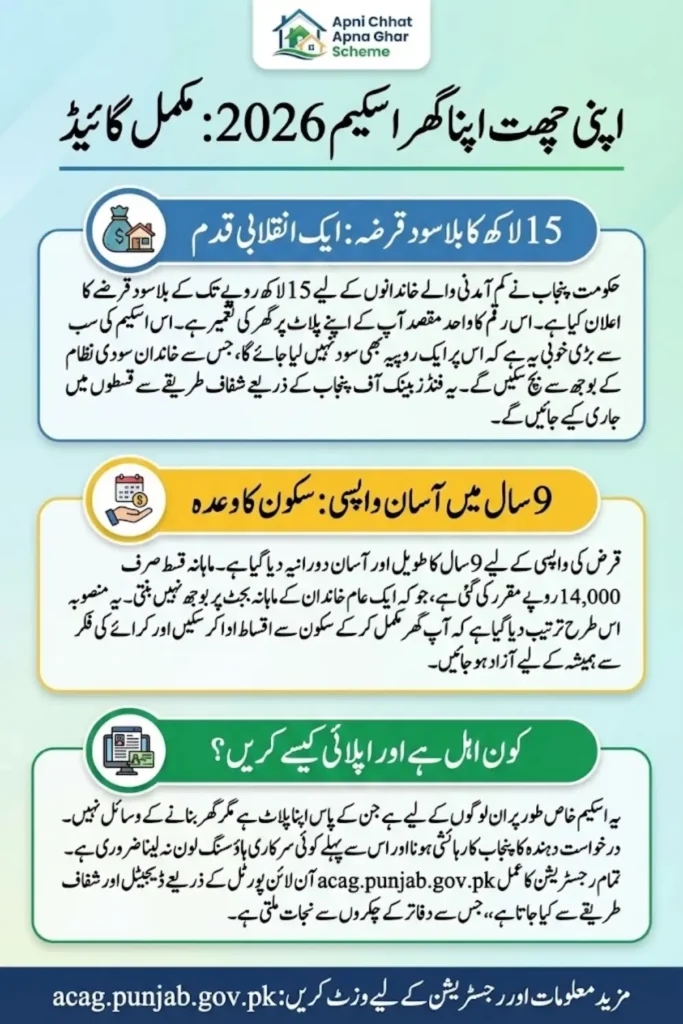

Acag.punjab.gov.pk In Punjab, owning a house is not just a basic need but a lifelong dream for millions of families. Over the years, I have personally seen many families who own small plots of land but are unable to build a house because their income barely covers daily expenses. Construction costs, rising material prices, and lack of savings keep them stuck for years. To address this real and visible problem, the Punjab government introduced the Apni Chhat Apna Ghar initiative under the leadership of Chief Minister Maryam Nawaz Sharif.

This scheme focuses on helping people who already have land but lack financial strength. Instead of offering houses at distant locations, the government decided to empower families to build homes on their own plots through an interest-free loan system. The official acag.punjab.gov.pk portal plays a key role in managing registrations, balloting, and loan distribution in a transparent way.

You Can Also Read: Winter Vacation in Punjab 2026 Notification

Vision Behind Apni Chhat Apna Ghar Program

The vision of Apni Chhat Apna Ghar is deeply rooted in ground realities. The government recognized that low-income families do not want luxury houses; they want secure shelter built with dignity. This scheme is designed to reduce dependence on private lenders who charge high interest and trap families in long-term debt.

What makes this program different is its focus on responsibility and sustainability. Instead of giving free cash, the government provides structured, interest-free loans that encourage families to complete construction and repay in manageable installments. This approach strengthens financial discipline while ensuring long-term housing security.

The main goals of the scheme include:

- Supporting land-owning but cash-poor families

- Reducing homelessness in Punjab

- Promoting self-construction instead of handouts

- Ensuring transparency through digital verification

You Can Also Read: GTS Phase 3 Online Registration Portal Started – Know Eligibility Criteria

Who Can Benefit From the 15 Lakh Interest-Free Loan

The Apni Chhat Apna Ghar loan is not meant for everyone. It is strictly targeted at low-income households that genuinely need financial support for house construction. Applicants are assessed carefully to ensure that funds reach deserving families and are not misused.

In many districts, I have observed that families with small plots often live in rented portions or temporary structures. This scheme gives such families a real opportunity to move into their own homes. However, meeting eligibility conditions is essential before applying.

The scheme mainly benefits:

- Residents of Punjab province

- Families with limited monthly income

- Applicants who have never received a government housing loan

- Individuals willing to follow verification and repayment rules

You Can Also Read: Ration Card Punjab Online Check 2026

Plot Size Rules for Urban and Rural Applicants

To keep the scheme fair and focused on low-income housing, the government has fixed clear plot size limits. These limits prevent misuse by large landowners and ensure that benefits go to families who truly need assistance.

Urban and rural areas have different housing patterns, which is why separate limits are defined. Applicants must provide ownership documents that clearly show the plot size and location.

| Area Category | Allowed Plot Size |

|---|---|

| Urban Areas | Up to 5 Marla |

| Rural Areas | Up to 10 Marla |

These limits ensure that modest homes are constructed rather than large commercial buildings.

Overview of acag.punjab.gov.pk Online Portal

The acag.punjab.gov.pk portal is the central system that connects applicants with the government and banks. From my observation, this digital system has significantly reduced unnecessary visits to offices and minimized the role of agents.

Through this portal, applicants can track their status, check balloting results, and receive official updates. Even people with basic internet knowledge can easily use it with the help of family members or local internet centers.

The portal allows users to:

- Check balloting results using CNIC

- Stay informed about loan phases

- Access official scheme updates

- Avoid misinformation from unofficial sources

You Can Also Read: 13500 Start For Eligible Women By Ehsaas Program

How to Check ACAG Balloting Results Using CNIC

Balloting is conducted to fairly select eligible applicants from a large number of registrations. This process is computerized to ensure transparency and equal opportunity.

Applicants do not need to visit offices or rely on agents. All they need is their CNIC number and access to the official portal.

To check results:

- Visit acag.punjab.gov.pk

- Enter your CNIC number

- View your selection status

Selected candidates are later guided about verification and loan procedures.

What Happens After Selection in ACAG Draw

Selection in the draw is an important milestone, but it is not the final step. After selection, applicants enter a verification phase where documents and eligibility are rechecked.

This stage ensures that only genuine applicants receive loans. From what I have seen, delays usually occur when applicants do not complete bank-related formalities on time.

After selection, applicants must:

- Prepare CNIC and property documents

- Visit the assigned Bank of Punjab branch

- Complete verification and account setup

You Can Also Read: 8171 Check Online Ehsaas Tracking

Bank of Punjab’s Role in Loan Disbursement

The Bank of Punjab is the official partner for loan disbursement under this scheme. Its involvement ensures that funds are handled through a secure and accountable banking system.

Loans are transferred directly to verified accounts, reducing chances of fraud. Bank officials also guide applicants regarding repayment schedules and installment management.

The bank assists with:

- Opening or verifying accounts

- Transferring loan amounts

- Managing installment records

- Providing repayment guidance

Loan Verification and Witness Requirement

Before loan approval, applicants must complete a verification process that includes providing two witnesses. These witnesses confirm the applicant’s identity and residency.

This step may seem strict, but it protects the scheme from misuse. Witnesses are usually local residents with valid CNICs and known backgrounds.

Verification includes:

- CNIC authentication

- Property document checking

- Witness confirmation

You Can Also Read: Ehsaas Punjab Gov Pk | Ehsaas Program Registration

Interest-Free Loan Amount and Usage Conditions

Under the Apni Chhat Apna Ghar scheme, eligible families can receive an interest-free loan of up to 15 lakh rupees. This amount is strictly for house construction and related expenses.

The loan is often released in stages, depending on construction progress. This ensures that funds are used responsibly and homes are completed properly.

Loan conditions include:

- Construction-related use only

- No resale or commercial use

- Compliance with inspection requirements

Loan Repayment Duration and Monthly Installments

One of the strongest features of this scheme is its easy repayment plan. Families are given up to nine years to repay the loan, making it manageable even for low-income households.

With monthly installments of around 14,000 rupees, repayment becomes realistic without disturbing household budgets. This long repayment period reduces financial pressure on families.

Progress and Achievements of ACAG Till 2025

By 2025, the Apni Chhat Apna Ghar scheme has shown visible results across Punjab. Thousands of homes are either completed or under construction, reflecting strong implementation.

Second loan tranches have been released to many beneficiaries, showing that the government is committed to completing projects rather than stopping at approvals.

Major achievements include:

- Thousands of houses under construction

- Multiple districts covered

- Improved loan distribution speed

Development Work Across Punjab Districts

Housing development under this scheme is spread across many districts. Both urban and rural areas are receiving attention, ensuring balanced growth.

Completed housing schemes and developed plots show that this initiative is not limited to announcements but is visible on the ground.

Development highlights include:

- Dozens of housing schemes completed

- Thousands of plots developed

- Coverage across more than 20 districts

Committee Formation for Free Plot Policy

To further strengthen housing support, an eight-member committee has been formed. Its role is to finalize the framework for free plot distribution for deserving families.

This step shows the government’s long-term planning to address land ownership issues alongside construction financing.

Current Phase Updates and Loan Distribution Status

The current phase of the Apni Chhat Apna Ghar scheme is focused on speeding up loan distribution and monitoring construction progress. Applicants who have completed verification are receiving funds more efficiently.

From field observations, applicants who stay in contact with banks and district offices face fewer delays.

What Applicants Should Do If They Are Still Waiting

Applicants who are still waiting should remain proactive. Many delays happen due to missing documents or incomplete bank procedures.

Recommended actions include:

- Visiting the Bank of Punjab branch

- Confirming verification status

- Keeping documents updated

Support Channels and Complaint Resolution

For guidance and complaints, ACAG help desks are available at Deputy Commissioner offices. Applicants can also use official helplines for assistance.

These support channels ensure that applicants are not left confused during the process.

Key Benefits of Apni Chhat Apna Ghar Scheme

This scheme offers long-term benefits beyond financial support. It provides families with security, stability, and dignity.

Key advantages include:

- Interest-free loan up to 15 lakh

- Easy monthly installments

- Transparent digital process

- Government-backed security

Common Mistakes Applicants Should Avoid

Many applicants face unnecessary delays due to simple mistakes. Awareness can help speed up approval.

Common mistakes include:

- Incorrect CNIC details

- Incomplete property documents

- Delayed bank visits

Final Thoughts on ACAG Loan Scheme 2026

The Apni Chhat Apna Ghar scheme is one of the most practical housing initiatives introduced in Punjab. It understands the struggles of ordinary citizens and offers a realistic solution rather than empty promises.

If you meet the eligibility criteria, this scheme can turn your long-standing dream of owning a home into reality. Stay connected with official sources, follow the process carefully, and take a confident step toward a secure future.